While US markets navigate trade policy turbulence, Bangalore’s economy—driven by $76 billion in software exports and generating 31% of India’s GDP with just 20% of its population—creates a foundation for sustainable real estate growth independent of global trade tensions.

Executive Summary

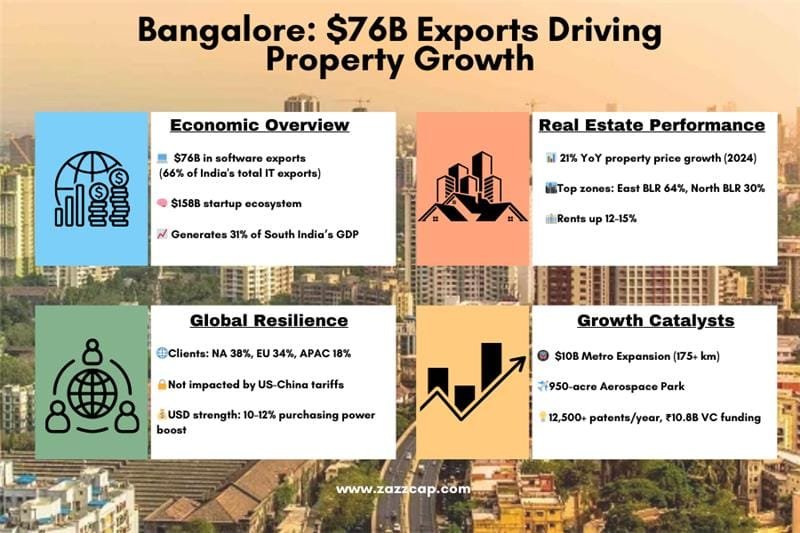

As US investors face increasing volatility from shifting trade policies, diversification into markets with independent economic drivers becomes essential for portfolio resilience. Bangalore’s economy offers precisely this independence—a growth engine powered by technology exports, domestic consumption, and innovation that operates largely uncorrelated with US-China trade dynamics. This analysis explores how Bangalore’s economic strength—generating $76 billion in software exports alone while producing 31% of India’s GDP despite housing just 20% of its population—creates sustainable real estate growth regardless of global trade tensions. With a projected 8-10% annual price appreciation in key areas and commercial spaces experiencing 12-15% rent increases, Bangalore’s economy-backed real estate market represents a compelling diversification opportunity for US investors seeking both protection from domestic market turbulence and exposure to one of the world’s most dynamic growth stories.

The Export Powerhouse: Scale and Significance

Understanding Bangalore’s economic strength begins with appreciating the sheer scale of its export economy and its significance within India’s broader economic landscape.

Export Economy Metrics

The numbers tell a compelling story:

- $76 billion in software exports annually, representing two-thirds of India’s total IT exports

- $158 billion startup ecosystem valuation, among the highest in Asia

- 40+ unicorns (startups valued at $1+ billion) headquartered in the city

- 66% of India’s IT exports originate from Bangalore

This export economy creates a robust foundation for consistent economic growth, driving demand across all real estate segments.

Beyond IT: Export Diversification

While technology dominates the headlines, Bangalore’s export economy has diversified significantly:

- Aerospace and aviation: The Bengaluru Aerospace Park spans 950 acres, attracting global companies like Airbus, Boeing, and Rolls Royce

- Biotechnology and pharmaceuticals: 60% of India’s biotech companies have Bangalore operations

- Electronic manufacturing: Growing presence in electronic component and finished product exports

- Precision engineering: Expanding specialized manufacturing exports, particularly in aerospace and defense sectors

This diversification reduces dependency on any single export category, creating economic resilience that supports sustainable real estate appreciation.

Economic Structure: Why Bangalore Moves Independently

Bangalore’s economy operates with significant independence from US-China trade dynamics due to its unique structural characteristics. Understanding these structural elements helps explain why Bangalore real estate represents true diversification for US investors.

Domestic Economic Integration

While exports matter, Bangalore’s economy is equally anchored by domestic consumption and integration:

- 31% of South India’s GDP generated in the Bangalore region

- Karnataka’s economic growth consistently outpacing national averages by 1-1.5%

- Growing domestic market for technology services and products

- Urban population growth of 3.2% annually, creating sustained internal demand

This domestic orientation provides insulation from international trade disputes and tariff policies.

Client Diversification

Bangalore’s export clients span the globe, reducing dependency on any single market:

- North America: 38% of technology export revenue

- Europe: 34% of technology export revenue

- Asia-Pacific: 18% of technology export revenue

- Rest of world: 10% of technology export revenue

This global diversification means that even if US-related business faces headwinds, other markets can compensate, maintaining overall economic stability.

Value Chain Positioning

Bangalore occupies specific positions in global value chains that are less vulnerable to trade disputes:

- Knowledge services rather than physical goods subject to tariffs

- Intellectual property creation rather than manufacturing assembly

- Business process integration creating high switching costs for clients

- Mission-critical functions that continue regardless of trade conditions

This strategic positioning in global value chains creates resilience against the trade tensions affecting manufacturing-focused economies.

Employment Impact: The Foundation of Housing Demand

Bangalore’s export economy translates directly into employment that drives housing demand across multiple segments.

Direct Employment Generation

The export sector creates significant direct employment:

- Over 1.5 million technology professionals employed in export-oriented roles

- Average annual salary growth of 8-10% in export-focused companies

- 100,000 engineers graduating annually, creating a continuous talent pipeline

- Premium compensation packages supporting luxury and premium housing demand

This employment engine creates consistent demand for housing across multiple price points.

Employment Composition Evolution

The nature of Bangalore’s employment base is evolving in ways that strengthen its economic resilience:

- Engineering and manufacturing: Now representing 47% of recent office leasing activity

- IT-BPM sector: Contributing 25% of commercial space absorption

- Global Capability Centers (GCCs): Leading with 45% of office leasing volume

- Flexible workspaces: Capturing 19% of recent leasing activity

This diversification of employment sectors reduces dependence on any single industry while maintaining focus on high-value knowledge work.

Multiplier Effect

Beyond direct employment, the export economy creates additional jobs throughout the economic ecosystem:

- 2.5x multiplier effect with each direct job creating 1.5 additional indirect jobs

- Service sector growth supporting export businesses

- Retail and hospitality expansion catering to the export workforce

- Construction and real estate employment creating a virtuous cycle

This employment multiplier effect spreads economic benefits throughout the region, supporting broad-based real estate demand.

Strategic Growth Initiatives: Accelerating Economic Development

Bangalore’s economic momentum is being further enhanced by strategic growth initiatives designed to strengthen its position in the global knowledge economy.

Technology and Innovation Parks

Purpose-built environments for economic growth include:

- Bangalore Signature Business Park: A 407-acre development adjacent to Kempegowda International Airport rivaling Gujarat’s International Finance Tec-City

- BIAL Information Technology Investment Region (ITIR): A massive 12,000-acre project proposed at Devanahalli

- Bengaluru Aerospace Park: A specialized 950-acre aerospace and aviation industry park attracting global companies

These purpose-built environments create concentrated zones of economic activity that drive both commercial and residential real estate demand in surrounding areas.

Venture Capital and Foreign Direct Investment

Capital inflows continue fueling Bangalore’s innovation economy:

- $10.8 billion in venture funding raised in 2022

- Leading India’s recent $1.65 billion funding wave in early 2025

- ₹100 crore VC fund for AI and EV startups

- ₹50 lakh grants for deep tech startups

This capital infusion fuels continued company formation, job creation, and premium office and housing demand.

Economic Complexity: The Innovation Premium

Bangalore’s economic positioning at the higher end of the value chain creates an innovation premium that enhances its resilience against global trade disruptions.

Knowledge Economy Advantages

As a knowledge economy hub, Bangalore benefits from specific advantages:

- High-value services less vulnerable to price competition

- Intellectual property development creating sustainable competitive advantages

- Innovation ecosystem effects with clustering benefits

- Talent attraction and retention supporting continued growth

These knowledge economy advantages create stable, long-term economic growth that supports real estate appreciation through market cycles.

Innovation Metrics

Key innovation indicators highlight Bangalore’s knowledge economy strength:

- 12,500+ patents filed annually from Bangalore-based entities

- 140+ research and development centers operated by global corporations

- 3,200+ technology startups founded in the past three years

- 18 technology company IPOs in the last 24 months

This innovation activity translates directly into high-quality employment and premium real estate demand.

Real Estate Implications: Economically-Driven Opportunities

Bangalore’s economic structure creates specific real estate opportunities that benefit from export-driven growth while maintaining independence from US market volatility.

Commercial Real Estate Dynamics

The export economy shapes commercial real estate in specific ways:

- Office space absorption: 6.7 million square feet gross leasing volume in Q4 2024

- Sector distribution: Engineering & manufacturing (47%), IT-BPM (25%), and flex spaces (19%)

- Corporate composition: Global Capability Centers (GCCs) leading with 45% of leasing activity

- Vacancy trends: Decreasing from 10.8% to a projected 8.5% by year-end

These commercial real estate fundamentals create a foundation for residential appreciation in surrounding areas.

Zonal Economic Impact

Different economic drivers create varied impacts across Bangalore’s zones:

- East Bangalore: Dominated by IT-BPM exports, leading the market with 64% of all new launches in Q2 2024

- North Bangalore: Aerospace and manufacturing focus, growing to 30% market share by Q3 2024

- South Bangalore: Mixed economic base with IT and biotechnology, maintaining 29% of launches

- West Bangalore: Emerging manufacturing hub with 33% quarterly sales growth

Understanding these zonal economic patterns allows investors to identify high-potential opportunities aligned with specific economic drivers.

Price and Rental Performance

Economic strength translates directly into real estate performance:

- 21% year-over-year price growth in 2024, the highest among major Indian cities

- 8-10% projected annual appreciation in key areas like East Bangalore, Koramangala, and Sarjapur Road

- 2-5% quarterly rental increases across major tech corridors

- Premium rental performance: Whitefield (₹28,000-₹40,000), Sarjapur Road (₹29,500-₹42,000), Thanisandra Main Road (₹26,000-₹38,000)

These performance metrics demonstrate the direct connection between economic strength and real estate returns.

Insulation from US Tariff Impacts: The Diversification Advantage

For US investors concerned about domestic market volatility driven by trade policies, Bangalore’s economy offers specific insulation advantages.

Trade Policy Independence

Key factors creating independence from US trade policies include:

- Service-dominated exports largely unaffected by goods-focused tariffs

- Intellectual property exports not subject to traditional trade barriers

- India’s independent trade relationships with multiple global partners

- Growing domestic consumption base reducing export dependency

These structural factors ensure that Bangalore’s real estate fundamentals remain strong regardless of US-China trade tensions.

Counter-Cyclical Opportunities

Some aspects of Bangalore’s economy actually benefit during periods of global trade uncertainty:

- Cost arbitrage advantages become more attractive during economic tightening

- Business process outsourcing often increases during cost-cutting cycles

- Innovation outsourcing accelerates as companies seek efficiency

- Digital transformation services remain essential regardless of economic conditions

These counter-cyclical elements create stability that translates to consistent real estate demand.

Infrastructure Support: Enabling Economic Growth

Bangalore’s economic potential is being further enhanced by significant infrastructure investments that improve connectivity and efficiency.

Transportation Network Expansion

Major transportation initiatives include:

- $10 billion metro expansion program: Adding over 175 km of new metro lines by 2026

- 141.32 km suburban rail network: Four corridors connecting suburban areas to the city center

- Satellite Town Ring Road: 280 km ring connecting 12 towns in Bangalore’s periphery

- Bengaluru-Chennai Expressway: Enhancing eastern corridor connectivity

These connectivity improvements reduce transportation friction, enhance labor market efficiency, and open new areas for economic development.

Strategic Economic Corridors

Planned economic corridors are creating focused zones of activity:

- Chennai–Bengaluru Industrial Corridor (CBIC): 8,484 acres of development in the Tumakuru node

- Hyderabad Bengaluru Industrial Corridor (HBIC): Connecting central India to southern economic centers

- Bengaluru Mumbai Industrial Corridor (BMIC): Creating an east-west economic axis

These corridors create structured pathways for economic expansion and identify high-potential areas for future real estate appreciation.

Currency Dynamics: The Dollar-Rupee Advantage

For US-based investors, currency dynamics create additional advantages when investing in Bangalore real estate.

Purchasing Power Benefits

Current currency valuations favor dollar-based investors:

- Historical trend analysis: Rupee has depreciated at 3-4% annually against USD over 10 years

- Current position: Analysts consider rupee modestly undervalued by 8-10%

- Purchasing power advantage: US investors enjoy approximately 10-12% greater purchasing power compared to 18 months ago

- Acquisition timing: Current window considered favorable for dollar-denominated investments

These currency dynamics enhance potential returns for US investors beyond the underlying real estate appreciation.

Income Repatriation Strategy

Strategic approaches to repatriating rental income can further enhance returns:

- Timing optimization: Flexibility to repatriate during favorable exchange rate periods

- Hedging strategies: Options to lock in exchange rates for predictable returns

- Reinvestment alternatives: Opportunities to compound returns locally before repatriation

- Tax-efficient structures: Entity formations that optimize cross-border income flows

These currency management strategies can add 1-3% to annual returns for sophisticated investors.

Investment Strategy: Capitalizing on Export-Driven Growth

For US investors seeking to benefit from Bangalore’s export-driven economy while gaining insulation from domestic market volatility, we recommend specific strategic approaches.

Target Investment Areas

Export economy strength creates opportunities in specific locations:

- East Bangalore: Particularly Whitefield and Sarjapur Road, which have demonstrated strongest technology-driven appreciation

- North Bangalore: Areas surrounding aerospace parks and strategic technology zones

- Devanahalli-Bagalur Corridor: Airport-adjacent development with projected 12-15% annual appreciation

- Infrastructure-adjacent properties: Locations within 1 km of new metro and suburban rail stations

Investment Structures

Optimal investment structures for US-based investors include:

- Direct ownership: For maximum control and long-term appreciation

- Fractional ownership: For diversified exposure with lower capital requirements

- Private equity participation: For institutional-quality assets and professional management

- Development partnerships: For higher returns through project-specific investments

Bottom Line: Economic Resilience as the Foundation for Real Estate Returns

As US investors navigate uncertain domestic markets, Bangalore’s export-driven economy provides a compelling alternative. The city’s position as an export powerhouse—generating $76 billion in software exports alone and contributing disproportionately to India’s GDP—creates sustainable demand for quality real estate across multiple segments.

The unique structure of Bangalore’s economy, focused on knowledge services rather than physical goods subject to tariffs, provides true diversification from the trade tensions affecting US markets. With East Bangalore capturing 64% of new launches in Q2 2024, North Bangalore growing to 30% market share by Q3, and premium housing demand driving 21% year-over-year price growth, the economic foundation for strong real estate performance remains solid.

This economic foundation, combined with favorable currency dynamics for dollar-based investors, creates an opportunity to achieve both portfolio protection and growth potential through strategic real estate investments.

For US investors—particularly those of Indian origin with cultural familiarity—Bangalore’s export-driven real estate market offers a rare combination: exposure to one of the world’s most dynamic growth stories with insulation from the very factors creating volatility in domestic markets.

Zazz Capital connects US-based investors to premium real estate opportunities in Bangalore, India. Our team provides end-to-end investment solutions including entity structuring, property acquisition, management, and eventual exit. Contact our investment advisors to learn more about current opportunities.