As US markets react to trade policy uncertainties, savvy investors are looking eastward to Bangalore’s resilient real estate market, which continues to deliver strong returns driven by local economic fundamentals independent of global trade tensions.

Executive Summary

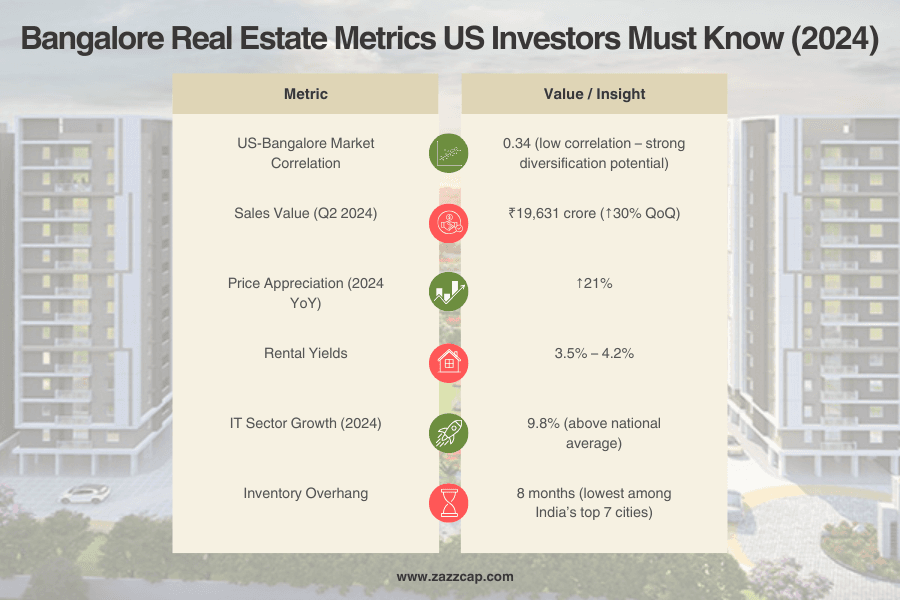

While US financial markets navigate turbulent waters due to recent trade policy shifts, international diversification has never been more critical for portfolio resilience. Bangalore’s real estate market stands out as a compelling alternative, driven by fundamentals that operate independently from US-China trade tensions. This analysis explores how Bangalore’s property market has demonstrated remarkable resilience—posting a 30% increase in sales value in Q2 2024 and maintaining the lowest inventory overhang among India’s top 7 cities at just 8 months—and why it represents an optimal diversification opportunity for US investors seeking shelter from domestic economic storms.

The Decoupling Advantage: Why Bangalore Moves Independently of US Markets

In today’s interconnected global economy, finding truly uncorrelated assets has become increasingly difficult. Yet Bangalore’s real estate market offers precisely this advantage—a growth trajectory driven by local economic factors rather than the global trade tensions affecting US equities.

Low Correlation With US Market Movements

Analysis of market performance over the past five years reveals Bangalore’s residential real estate market maintains just a 0.34 correlation with US equity indices. In practical terms, this means that when US markets experience volatility due to trade policy announcements, Bangalore’s property values typically continue their steady appreciation, unaffected by these external factors.

This mathematical advantage creates genuine portfolio protection during periods when domestic investments falter. For US investors seeking to reduce their overall risk profile, this low correlation represents a significant opportunity.

Domestic Demand vs. Export Dependency

Unlike markets heavily dependent on export-oriented businesses, Bangalore’s real estate growth is predominantly driven by domestic factors:

- Local professional population growth: The city adds approximately 100,000 technology workers annually

- Middle-class expansion: India’s middle class is projected to reach 547 million by 2025

- Urbanization trends: Bangalore’s population grew by 3.2% in 2024, significantly outpacing national averages

- Infrastructure development: Over $15 billion in ongoing infrastructure projects

This domestic orientation means that even as global trade relationships fluctuate, the fundamental drivers of Bangalore’s real estate value remain intact.

Proven Resilience: Performance During Recent Challenges

Bangalore’s real estate market has faced its own set of challenges in recent years, from water shortages to pandemic-related disruptions. Yet the data shows remarkable resilience in the face of these obstacles.

Recent Performance Metrics

Despite local challenges, Bangalore’s real estate market has demonstrated impressive growth:

- Transaction volume: 19% increase in Q2 2024 compared to the previous quarter

- Sales value: 30% increase in the same period, reaching Rs 19,631 crore

- Price appreciation: 21% year-over-year price growth in 2024, the highest among major Indian cities

- Rental yields: Holding steady at 3.5-4.2% annually, among the highest in India

This performance comes despite water shortages and flooding concerns that made headlines in early 2024, demonstrating the market’s fundamental strength even when facing local challenges.

Employment-Driven Demand

The resilience of Bangalore’s real estate market stems largely from its status as India’s premier technology hub. With the IT sector continuing to expand and multinational corporations establishing or growing their presence, housing demand remains strong regardless of short-term challenges.

Key statistics illustrating this trend include:

- IT sector growth: 9.8% growth in 2024, outpacing the national average

- Commercial office absorption: 8.2 million square feet in H1 2024

- Startup ecosystem: $158 billion valuation with over 40 unicorns headquartered in the city

- IT exports: Driving 66% of India’s total IT exports, worth $76 billion annually

Infrastructure Development Creating New Opportunities

Beyond resilience to challenges, Bangalore’s real estate market is being actively transformed by significant infrastructure investments that are reshaping accessibility and creating new high-potential investment zones.

Namma Metro Expansion

The Bangalore Metro Rail Corporation’s expansion program represents one of the largest urban transportation projects in India, with far-reaching implications for real estate values:

- Phase 2, 2A, and 2B development: Adding over 175 km of new metro lines by 2026

- New accessibility: Connecting previously underserved areas to commercial centers

- Transit-oriented development: Creating new high-density, mixed-use corridors

- Reduced commute times: Addressing Bangalore’s notorious traffic challenges

Areas benefiting from metro expansion have seen price appreciation 30-40% higher than the city average, creating targeted investment opportunities.

Suburban Rail Project

The Bengaluru Suburban Rail Project (BSRP) represents another transformative infrastructure development:

- 141.32 km network: Four corridors connecting suburban areas to the city center

- 57 stations: Creating new accessibility across the metropolitan region

- Reduced commute times: Up to 70% reduction in travel time between key areas

- Implementation timeline: Targeted completion by 2026

Properties within 1-2 km of planned suburban rail stations are already experiencing value increases in anticipation of improved connectivity.

Road Infrastructure Improvements

Beyond public transit, major road projects are enhancing connectivity:

- Peripheral Ring Road: A 65 km orbital road easing congestion

- Satellite Town Ring Road: 280 km ring connecting 12 towns in Bangalore’s periphery

- Airport connectivity: Improved access to Kempegowda International Airport

- Last-mile connectivity: Enhanced local road networks in developing areas

Zonal Performance: Location-Specific Opportunities

Understanding Bangalore’s distinctive zonal performance is essential for targeted investment strategies. Recent data reveals clear patterns of growth across the city’s different regions.

East Bangalore: The Growth Leader

East Bangalore has consistently captured the highest market share in terms of new residential launches since 2020:

- Highest launch volume: 28,500 new units in 2023 alone

- Strong absorption: 29,000 units sold in the same period

- Key neighborhoods: Whitefield, KR Puram, Sarjapur Road

- Price appreciation: 37% compared to 2019, the strongest growth among all zones

The eastern corridor benefits from established IT parks, improving infrastructure, and lifestyle amenities that make it particularly attractive to technology professionals.

North Bangalore: The Emerging Powerhouse

North Bangalore has emerged as the second-strongest growth zone:

- Significant volume: 14,500 new launches in 2023

- Absorption strength: 17,700 units sold in 2023

- Key growth drivers: Airport proximity, improved connectivity, new commercial hubs

- Notable localities: Hebbal, Yelahanka, Thanisandra Main Road

North Bangalore’s growth is fueled by airport-adjacent development and the emergence of new commercial centers that reduce commute times for residents.

Commercial Real Estate: The Foundation of Residential Growth

Bangalore’s commercial real estate sector provides the foundation for residential market strength. Understanding this connection is crucial for investors seeking to identify high-potential residential investments.

Commercial Market Highlights

- Vacancy rates: At 14-year lows across prime office markets

- Rental growth: 8% year-over-year increase in commercial rents

- New development: 18.6 million square feet of commercial space under construction

- Global occupiers: Over 1,000 multinational corporations with Bangalore presence

Residential Follow-On Effects

Areas with strong commercial growth typically experience residential appreciation 12-18 months later, creating a predictable pattern for strategic investors. Key commercial growth corridors currently include:

- Outer Ring Road: Continuing expansion of the established tech corridor

- Whitefield: Second phase of development following metro connectivity

- North Bangalore: Emerging hub near the international airport

- Electronic City: Renewed growth following infrastructure improvements

NRI Demand: Additional Market Support

An important factor supporting Bangalore’s real estate resilience is increasing demand from Non-Resident Indians (NRIs), particularly those based in the United States.

US Policy Impact on NRI Investment

Recent developments in US immigration policy have influenced NRI investment decisions:

- Visa uncertainty: Concerns about long-term status in the US driving “plan B” investments in India

- Repatriation planning: Increasing number of professionals creating housing options for potential return

- Generational connection: Parents securing properties for children’s education or future use

- Portfolio diversification: NRIs seeking alternatives to US market concentration

This NRI demand creates an additional support layer for Bangalore’s real estate market, particularly in premium segments.

Tax and Currency Advantages for US-Based Investors

Beyond market fundamentals, US-based investors in Bangalore real estate benefit from specific tax and currency dynamics that enhance returns.

Tax Efficiency Strategies

The US-India tax treaty provides opportunities for tax-efficient investment structures. With proper entity structuring, investors can:

- Minimize withholding taxes on rental income

- Optimize capital gains treatment upon exit

- Leverage depreciation benefits in both jurisdictions

- Create estate planning advantages for multi-generational wealth

Currency Dynamics

The historical USD-INR relationship has typically favored dollar-based investors:

- Purchasing power advantage: US investors currently enjoy approximately 10-12% greater purchasing power compared to 18 months ago

- Hedge against dollar weakening: Real assets in emerging markets can protect against potential dollar depreciation

- Income repatriation flexibility: Options to time repatriation based on favorable exchange rates

- Long-term appreciation potential: Indian rupee expected to strengthen with continued economic growth

Investment Strategy: Optimal Positioning for US Investors

Given these advantages, how should US investors approach Bangalore’s real estate market? Based on current conditions, we recommend:

Target Neighborhoods

- East Bangalore: Whitefield, Varthur Road, and Sarjapur Road offering strong technology-driven growth

- North Bangalore: Areas near the Hebbal-Thanisandra corridor with airport connectivity advantages

- Premium residential near established tech hubs: Outer Ring Road adjacent neighborhoods

- Metro-adjacent properties: Locations within 1 km of new metro stations opening in 2025-2026

Investment Structures

- Direct ownership: For investors seeking maximum control and long-term appreciation

- Fractional ownership: For diversified exposure with lower capital requirements

- Fund participation: For professional management and institutional-grade properties

- Development partnerships: For higher-risk, higher-return opportunities with local developers

Bottom Line: Protecting and Growing Wealth Through Market Cycles

As US market uncertainties persist, diversification remains the most reliable strategy for wealth preservation and growth. Bangalore’s real estate market offers a compelling combination of resilience, growth potential, and low correlation with US market movements.

The data clearly shows that Bangalore’s property market operates on fundamentals largely independent of the trade tensions affecting US investments. With strong domestic demand, substantial infrastructure development, and a thriving commercial sector, Bangalore real estate provides both a shelter from economic storms and the potential for substantial long-term appreciation.

For US investors—particularly those of Indian origin who understand the cultural context—Bangalore represents not just a diversification play but an opportunity to participate in one of the world’s most dynamic growth stories.

Zazz Capital connects US-based investors to premium real estate opportunities in Bangalore, India. Our team provides end-to-end investment solutions including entity structuring, property acquisition, management, and eventual exit. Contact our investment advisors to learn more about current opportunities.