As we navigate through 2025, Bangalore’s real estate market is poised for strategic growth, with data projecting 8-10% annual price appreciation in key areas like East Bangalore, Koramangala, and Sarjapur Road, while commercial spaces in ORR and Whitefield show even stronger potential.

Executive Summary

For investors planning their 2025 strategy, understanding Bangalore’s real estate trajectory requires both macro-level insights and micro-market analysis. This forecast combines economic indicators, infrastructure development timelines, supply-demand dynamics, and regulatory factors to provide a comprehensive outlook for different property segments and neighborhoods. Our analysis projects continued resilience with residential property prices in prime areas rising 8-10% annually, building on the impressive 19% year-on-year growth observed in early 2024. With inventory overhang holding steady at just 8 months—the lowest among India’s top 7 cities—and commercial spaces in key corridors outperforming the broader market, Bangalore presents compelling opportunities for strategic investors seeking both growth and stability.

Economic Foundations: The Macro View for 2025

Bangalore’s real estate market doesn’t exist in isolation—it’s shaped by broader economic forces that establish the foundation for property performance. Understanding these macro trends is essential for accurate market forecasting.

GDP Growth and Economic Indicators

India’s economy continues its growth trajectory, with specific benefits for Bangalore:

- National GDP growth: Projected at 6.5-7% for fiscal year 2025-26

- Karnataka state growth: Expected to outperform national average at 7.2-7.5%

- Bangalore economic contribution: Approximately 38% of Karnataka’s GDP

- Per capita income growth: 9.5% annual increase in Bangalore, significantly above national average

These strong economic fundamentals provide the essential backdrop for real estate appreciation, supporting both end-user demand and investment activity.

Employment Trends

Employment growth drives housing demand, and Bangalore continues to lead in job creation:

- Technology sector: 110,000+ new jobs projected in 2025

- Financial services: 30,000+ new positions in fintech and traditional finance

- Manufacturing and engineering: 47% of recent office leasing activity in Q4 2024

- Global Capability Centers (GCCs): Leading office leasing with 45% of absorption

This sustained employment growth translates directly to housing demand across multiple segments, from affordable to luxury.

Supply-Demand Analysis: The Foundation of Price Projections

Real estate prices ultimately reflect the balance between supply and demand. Analyzing these dynamics at both city and micro-market levels reveals significant insights for 2025.

Residential Supply Pipeline

New housing supply in Bangalore shows distinct patterns for 2025:

- Overall new launches: Projected at 48,000-52,000 units, a 7% increase from 2024

- Premium segment concentration: 41% of new supply in properties priced over ₹7,500 per square foot

- High-end segment dominance: 54% of all Q3 2024 launches, showing a 10% quarter-on-quarter growth

- Affordable segment constraints: Only 10% of demand in the affordable segment (< ₹5,000 per square foot)

This supply distribution, heavily weighted toward premium and high-end properties, creates potential supply constraints in the affordable segment.

Demand Projections

Residential demand for 2025 shows continued strength:

- Projected absorption: 58,000-62,000 units, exceeding new supply

- Inventory position: 46,300 units available as of Q3 2024, with minimal quarterly growth

- Inventory overhang: Steady at 8 months, the lowest among all top 7 cities

- Buyer profile: Shifting toward more premium segments, with 46% preferring 3BHK units in Q1 2024

The projected demand-supply imbalance—with demand exceeding new supply by approximately 10,000 units—creates a favorable environment for price appreciation.

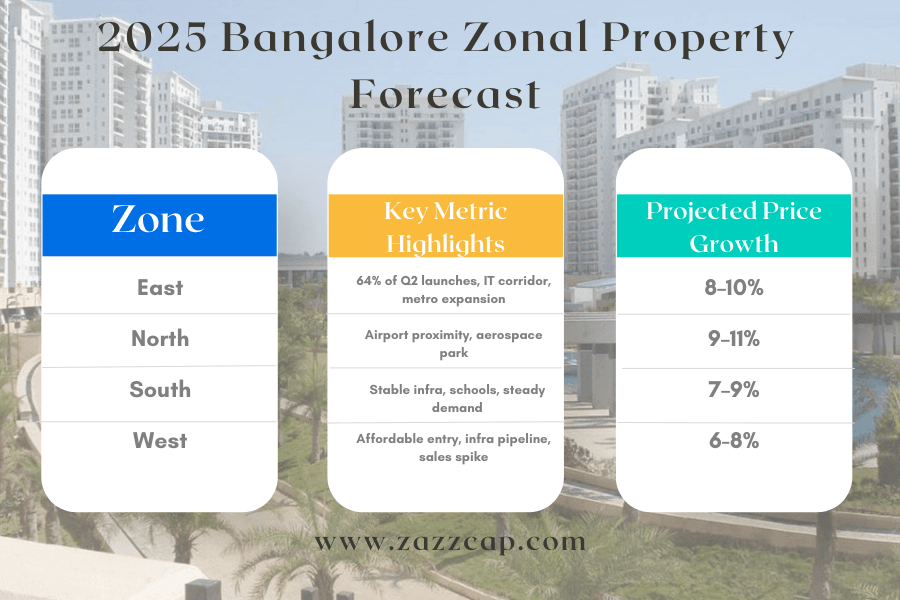

Zonal Analysis: Location-Specific Projections

Bangalore’s real estate market is not monolithic—each zone has distinct drivers and prospects. Our analysis identifies several high-potential areas for 2025 based on recent performance data.

East Bangalore: Consistent Market Leader

East Bangalore continues to dominate the market across key metrics:

- Launch activity: Captured 49% of all new launches in Q1 2024

- Market concentration: Dominated with 64% of all launches in Q2 2024

- Price projection: 8-10% annual appreciation

- Key growth drivers: Metro connectivity, IT corridor expansion, retail development

- Investment recommendation: Strong buy for long-term appreciation and rental returns

North Bangalore: The Rising Star

North Bangalore shows strongest momentum for future growth:

- Launch trajectory: From 33% market share in Q1 to 30% in Q3 2024

- Growing demand: Areas like Devanahalli, Bagalur, and Thanisandra Main Road gaining popularity

- Price projection: 9-11% annual appreciation

- Key growth drivers: Airport proximity, aerospace park development, improving connectivity

- Investment recommendation: Early-stage opportunity with significant upside potential

South Bangalore: Stable Performer

South Bangalore maintains its appeal with consistent performance:

- Launch activity: 29% of new launches by Q3 2024

- Buyer preference: Maintaining its status as a top choice for homebuyers

- Price projection: 7-9% annual appreciation

- Key growth drivers: Established infrastructure, educational institutions, retail amenities

- Investment recommendation: Balanced investment with moderate growth and stability

West Bangalore: Emerging Opportunity

West Bangalore shows signs of emerging potential:

- Sales momentum: 33% quarterly increase in sales in Q3 2024

- Price projection: 6-8% annual appreciation with potential for acceleration

- Key growth drivers: Affordability advantage, upcoming infrastructure improvements

- Investment recommendation: Long-term play with value acquisition opportunities

Neighborhood Analysis: Micro-Market Projections

Within each zone, specific neighborhoods offer distinct investment opportunities for 2025.

Whitefield: Infrastructure-Led Premium Growth

Following metro connectivity, this established tech hub enters a new growth phase:

- Price projection: 11-13% annual appreciation

- Current pricing: Average values increased from ₹5,870 per square foot in 2019 to ₹9,300 per square foot in 2024

- Key growth drivers: Metro operations, commercial expansion, integration with tech corridors

- Notable developments: Sumadhura Aspire Amber, Brigade ElDorado Beryl

- Investment recommendation: Buy for combined appreciation and rental yield

Sarjapur Road: Emerging Premium Corridor

Once considered peripheral, this area continues its transformation into a premium destination:

- Price projection: 10-14% annual appreciation

- Recent premium launches: Godrej Lakeside Orchard with units priced at ₹1.5-2.6 Cr

- Key growth drivers: International schools, tech park expansion, outer ring road connectivity

- Investment recommendation: Strong buy for maximum appreciation potential

Devanahalli-Bagalur Corridor: Airport-Driven Growth

This northern corridor shows exceptional growth potential:

- Price projection: 12-15% annual appreciation from a lower base

- Key growth drivers: Aerospace park development, airport expansion, improved connectivity

- Notable developments: Bangalore Signature Business Park, BIAL Information Technology Investment Region

- Investment recommendation: Strategic acquisition for highest long-term appreciation

Electronic City: Renewed Momentum

This established tech hub is experiencing a renaissance:

- Price projection: 8-10% annual appreciation

- Rental trends: Values growing from ₹18,000-₹27,000 in Q1 to ₹19,000-₹29,000 in Q3 2024

- Key growth drivers: Commercial resurgence, metro extension plans, price advantage relative to other tech hubs

- Investment recommendation: Value buy with strong rental potential

Property Segment Analysis: Performance by Housing Type

Beyond geography, different property types show distinct performance trajectories for 2025.

Luxury Segment (>₹1.5 Cr)

The premium market shows strong fundamentals:

- Price projection: 9-11% annual appreciation

- Absorption trend: 23% year-over-year increase in absorption

- Supply dynamics: Represents 13% of all Q3 2024 launches

- Buyer profile: 30% NRI buyers, 40% technology executives, 30% business owners

High-End Segment (₹80 Lakh – ₹1.5 Cr)

This segment demonstrates strongest growth momentum:

- Price projection: 8-10% annual appreciation

- Market dominance: 54% of all Q3 2024 launches

- Growth trajectory: 10% quarter-on-quarter growth

- Buyer profile: Primarily senior technology professionals and upgraders from mid-segment properties

Mid-Segment (₹40 Lakh – ₹80 Lakh)

The volume leader shows balanced growth:

- Price projection: 7-9% annual appreciation

- Market share: 28% of Q3 2024 launches

- Absorption trend: 15% year-over-year increase

- Buyer profile: 65% technology professionals, 20% financial services, 15% other sectors

Affordable Segment (< ₹40 Lakh)

Supply constraints create distinct dynamics in the affordable segment:

- Price projection: 6-8% annual appreciation

- Market share: Just 10% of demand in early 2024

- Supply challenges: Limited new launches in this segment

- Buyer profile: 80% first-time homebuyers, 20% investors targeting rental yields

Commercial Real Estate: The Office Market Outlook

Commercial real estate provides both direct investment opportunities and leading indicators for residential growth.

Office Space Dynamics

Bangalore’s office market shows strong fundamentals for 2025:

- Recent absorption: 6.7 million square feet gross leasing volume in Q4 2024

- Sector distribution: Engineering & manufacturing (47%), IT-BPM (25%), and flex spaces (19%)

- Corporate composition: Global Capability Centers (GCCs) leading with 45% of leasing activity

- Rent growth: 12-15% annual increases in prime locations

Commercial Growth Corridors

Key commercial areas show distinct growth patterns:

- ORR: Continued premium positioning with 14-16% rent increases

- Whitefield: Post-metro growth acceleration with 12-14% rent increases

- Electronic City: Infrastructure-led renewal with 10-12% rent increases

- North Bangalore: Emerging corridor with 16-18% rent increases from a lower base

Commercial-Residential Connection

Commercial growth typically precedes residential appreciation by 12-18 months. Based on current commercial trends, these residential areas show strong 2025-2026 potential:

- Thanisandra-Hebbal corridor: Following North Bangalore commercial expansion

- Sarjapur-Carmelaram belt: Benefiting from ORR commercial spillover

- Varthur-Gunjur area: Following Whitefield’s second growth wave

- Jigani-Electronic City Phase 2: Capturing Electronic City commercial expansion

Rental Market Projections: Income Potential Analysis

For investors focused on rental returns, 2025 offers specific opportunities across different segments.

Residential Rental Trends

The residential rental market shows strong recovery and growth:

- Average yield projection: 3.5-4.2%, among India’s highest for major cities

- Premium locations: Whitefield rentals reaching ₹28,000-₹40,000 per month

- Growth consistency: 2-5% quarterly increases across major tech corridors

- Lease duration trends: Increasing preference for 24-36 month leases

Rental Yield Leaders

Certain micro-markets offer enhanced rental performance:

- Whitefield: 4.0-4.2% yields with 3% quarterly growth

- Electronic City: 4.2-4.5% yields with values reaching ₹19,000-₹29,000 per month

- Sarjapur Road: 3.8-4.1% yields with rentals of ₹29,500-₹42,000 per month

- Thanisandra Main Road: 3.7-4.0% yields with values of ₹26,000-₹38,000 per month

Infrastructure Development: 2025 Completion Timeline

Ongoing and upcoming infrastructure projects will significantly impact property values in specific corridors during 2025.

Metro Expansion Impact

Namma Metro’s expanding network creates targeted opportunities:

- $10 billion metro program: Largest infrastructure investment reshaping the city

- Blue Line: Expected operational by 2026, connecting central Silkboard to Kempegowda International Airport

- Phase 2, 2A, and 2B: Adding over 175 km of new metro lines

- Property impact radius: 5-8% premium for properties within 500 meters of stations

Suburban Rail Project

The Bengaluru Suburban Rail Project represents another transformative development:

- 141.32 km network: Four corridors connecting suburban areas to the city center

- Implementation timeline: Phased completion beginning 2026

- Impact zones: 8-10% price advantage for areas gaining improved connectivity

- Focus corridors: Sampige line (KSR Bengaluru to Devanahalli) offering particular real estate potential

Road Infrastructure Timeline

Major road projects enhancing connectivity include:

- Peripheral Ring Road: Phase 1 completion expected Q3 2025

- Satellite Town Ring Road: 280 km ring connecting 12 towns around Bangalore

- Bengaluru-Chennai Expressway: Connecting Hoskote to Sriperumbudur, enhancing eastern corridor connectivity

- Impact zones: 8-12% price advantage for areas gaining improved connectivity

Regulatory Environment: Policy Impacts for 2025

Government policies and regulations will shape market dynamics in specific ways during 2025.

RERA Implementation Evolution

The Real Estate Regulatory Authority continues to mature:

- Compliance trends: 95% of new launches fully RERA compliant

- Dispute resolution: Average resolution time decreased to 75 days

- Consumer confidence impact: 15% increase in first-time homebuyer participation

- Developer consolidation: 20% reduction in active developers as smaller players exit the market

Tax Policy Impact

Tax regulations affecting real estate show important developments:

- GST implications: Maintained at 5% for under-construction properties

- TDS requirements: Consistent at 1% for properties above ₹50 lakhs

- Capital gains provisions: Unchanged holding period requirements for tax benefits

- Foreign investment regulations: Slight easing of repatriation requirements for NRIs

Investment Risk Analysis: Potential Headwinds

While the overall forecast remains positive, prudent investors should understand potential risks in the 2025 market.

Supply-Side Risks

Developers face specific challenges that could impact delivery timelines:

- Construction cost inflation: 8-10% increase in material costs

- Labor availability: Seasonal constraints during festival periods

- Approval timelines: Average 45-60 day delays in certain jurisdictions

- Funding constraints: Increased scrutiny from financial institutions

Demand-Side Considerations

Factors that could moderate demand include:

- Interest rate sensitivity: Each 50 basis point increase reduces affordability by 5%

- Employment stability: Technology sector reorganizations affecting buyer confidence

- Global economic impacts: Indirect effects from US and European market conditions

- Alternative investment competition: Equity markets and other asset classes

Portfolio Strategy: Optimal Allocation for 2025

Based on comprehensive market analysis, we recommend specific portfolio approaches for different investor profiles.

Conservative Investors

Lower-risk strategies emphasize capital preservation with modest growth:

- Asset allocation: 60% established premium areas, 40% mid-market growth corridors

- Property type mix: 70% residential, 30% commercial

- Hold period expectation: 5-7 years minimum

- Target return profile: 12-15% annual returns (capital appreciation plus rental income)

Balanced Investors

Moderate-risk strategies blend stability with enhanced return potential:

- Asset allocation: 40% premium areas, 45% high-growth corridors, 15% emerging locations

- Property type mix: 65% residential, 25% commercial, 10% mixed-use

- Hold period expectation: 4-6 years

- Target return profile: 15-18% annual returns

Growth-Oriented Investors

Higher-risk strategies focus on maximum appreciation potential:

- Asset allocation: 30% premium areas, 40% high-growth corridors, 30% emerging locations

- Property type mix: 50% residential, 30% commercial, 20% land or early-stage development

- Hold period expectation: 3-5 years

- Target return profile: 18-22% annual returns

Technology Impact: PropTech Trends Shaping the Market

Emerging technologies are reshaping Bangalore’s real estate landscape in ways that create both opportunities and challenges for investors.

Digital Transaction Platforms

Online property transactions continue gaining momentum:

- Digital documentation: 60% of transactions using digital documentation

- Virtual property tours: 40% increase in virtual tour adoption

- Blockchain for property records: Pilot programs in select neighborhoods

- Impact on sales cycle: 25% reduction in time from interest to purchase

Smart Home and Building Technology

Technology integration in properties creates new value propositions:

- Premium for smart homes: 4-6% price premium for fully automated homes

- Energy efficiency focus: 35% of new launches with significant sustainability features

- Security technology: 78% of premium projects with advanced security systems

- Connectivity requirements: Gigabit internet access becoming standard in premium segments

Bottom Line: Strategic Positioning for 2025

As Bangalore’s real estate market continues its growth trajectory in 2025, strategic investors have multiple pathways to participate in this dynamic market. The data points to sustained appreciation across multiple segments, with location-specific opportunities for enhanced returns.

Key takeaways for investors planning their 2025 strategy include:

- Zonal performance divergence continues: With East Bangalore dominating launches (64% in Q2 2024) while North Bangalore gains momentum (30% by Q3 2024), targeted investments in high-growth zones will significantly outperform city-wide averages.

- Premium segment outperformance persists: With 54% of launches in the high-end segment and growing demand for 3BHK configurations (46% of buyers), premium properties offer stronger growth potential.

- Infrastructure alignment creates opportunity: Properties near the $10 billion metro expansion and 141 km suburban rail network offer enhanced appreciation potential, particularly in north and east corridors.

- Commercial-residential synergy continues: With engineering & manufacturing (47%) overtaking traditional IT-BPM (25%) in commercial leasing, understanding evolving commercial patterns provides leading indicators for residential investment.

- Inventory advantage supports pricing: With inventory overhang holding steady at 8 months—the lowest among top 7 cities—and minimal quarterly growth in available units, the supply-demand imbalance supports continued price appreciation.

For US-based investors—particularly those of Indian origin with cultural familiarity—Bangalore’s real estate market in 2025 offers a compelling combination of growth potential, income generation, and diversification benefits. With proper market analysis and strategic positioning, investors can capture the significant upside potential while managing the specific risks inherent in emerging market real estate.

Zazz Capital connects US-based investors to premium real estate opportunities in Bangalore, India. Our team provides end-to-end investment solutions including entity structuring, property acquisition, management, and eventual exit. Contact our investment advisors to learn more about current opportunities.